IPB University Economics Expert: Duck Syndrome Proof of Middle Class Trapped by Social Demands and Financial Crisis

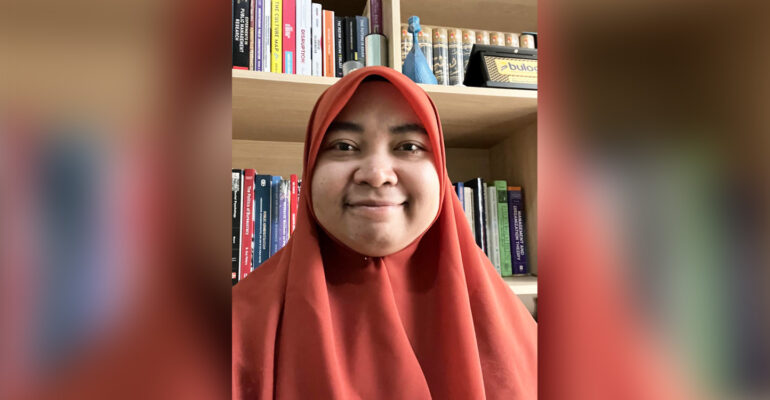

IPB University Economics Expert, Dr Anisa Dwi Utami, explained that the phenomenon of duck syndrome is a clear reflection of the social and economic pressures faced by the Indonesian middle class.

This phenomenon describes a condition when a person appears calm on the surface but is actually struggling under heavy pressure.

“Individuals from the middle class are often expected to appear successful, stable, and happy, even though they are actually facing great pressure emotionally and financially,” Dr Anisa said in her statement.

She added that high expectations from family, academic and professional competition, and social expectations reinforced by social media make many people feel like they have to look “perfect” all the time.

This condition, according to her, is exacerbated by limited access to psychological support and stigma towards mental health problems, so that the burden felt is often hidden in order to maintain an image.

As a lecturer at IPB University’s Faculty of Economics and Management, Dr Anisa also highlighted that the middle class is currently facing real economic pressures. High inflation and income stagnation mean they have to adapt to the rising cost of living.

“Food prices, especially rice, have risen significantly and forced many families to allocate most of their income only for basic needs,” she said.

She continued, the plan to increase the value-added tax (PPN) rate to 12 percent in 2025 further depresses purchasing power, especially if the minimum wage increase is only around 3-4 percent. The situation is exacerbated by the increasing cases of layoffs and the shift of workers to the informal sector.

The latest data shows that the average public savings is now only around Rp 4,6 million (November 2024), lower than the previous period. This condition, according to Dr Anisa, shows the inability of the middle class to keep up with the soaring cost of living.

She suggested that the middle class strengthen their financial literacy, develop a disciplined monthly budget, and prioritize basic needs and savings. In addition, income diversification and skill enhancement are also important to maintain financial stability.

“With a combination of wise financial management and self-development, the middle class can be more resilient to economic pressures and remain financially healthy,” she concluded. (dr) (IAAS/KDP)